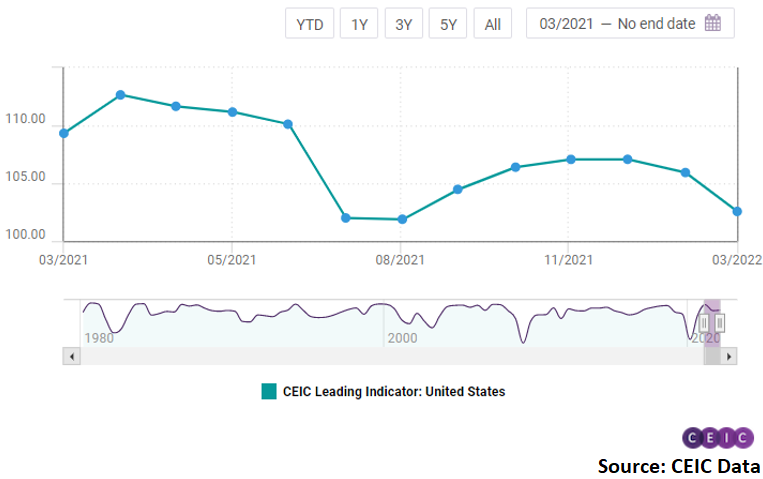

CEIC Leading Indicator for the US decelerates again in March

The CEIC Leading Indicator for the US decelerated for the second consecutive month in March 2022, decreasing by 3.3 points m/m to 102.6, according to the flash estimate. This is the lowest reading of the non-smoothed indicator since September 2021 and indicates that economic growth in the US has likely slowed in Q1 2022. The smoothed CEIC Leading Indicator also decelerated in March, falling to 104.4 but is still above the long-term trend of 100 and indicates that the US has been in continuous recovery since the first wave of the COVID-19 pandemic in 2020.

The Conference Board consumer confidence index rose slightly in March, to 107.2 from 105.7 in February, despite high inflation and rising commodity prices due to the war in Ukraine. The US labour market continued to tighten as jobless claims kept declining, the unemployment rate is almost at pre-pandemic levels and non-farm payrolls increased again in March, although at a slower pace compared to February. The housing market index declined for the third consecutive month, dropping below 80 for the first time since September 2021. The ISM manufacturing PMI decelerated to 51.1 in March from 58.6 in the previous month. This marked the 22nd consecutive month of manufacturing sector growth since the contraction in April 2020, but also the lowest reading since September 2020. Motor vehicle sales in March were down for the eighth consecutive month, by 22% y/y. The S&P 500 stock market index closed March 2022 at 4,530.4, up 3.6% m/m from the last day of February. The daily index managed to recover in the second half of March after plunging to a 10-month low of 4,170.7 on March 8. The more aggressive stance of the Federal Reserve regarding future rate hikes influenced the recovery of the index.

More about the US CEIC Leading Indicator here

Further data and analysis on the US economy are available on the CEIC US Economy in a Snapshot – Q1 2022 report.