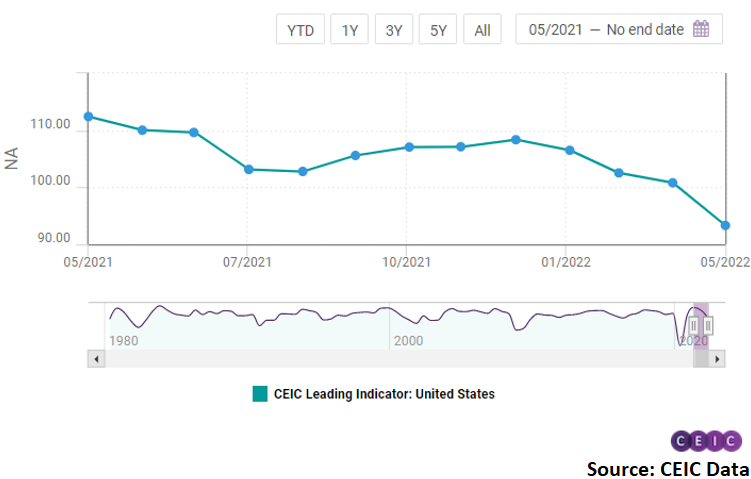

CEIC Leading Indicator for the US drops sharply in May

The CEIC Leading Indicator for the US fell to its lowest level since August 2020, decreasing by 7.5 points m/m to 93.3, according to the flash estimate. This is the fourth consecutive drop of the non-smoothed indicator and the sharpest since the first wave of COVID-19 in April 2020. The smoothed CEIC Leading Indicator also declined in May, falling to 97.1 from 99.8 in the previous May, signalling that the US economy is dropping pace in Q2 2022, after contracting in Q1.

May marked another month of declining vehicle sales in the US, as they dropped by 29.2% y/y, the sharpest decrease in two years and the tenth consecutive month of double-digit decline. The housing market index plummeted to its lowest level since June 2020, falling to 69 from 77 in April, as interest rate hikes are pushing mortgage rates up and home prices increase rapidly. The Conference Board consumer confidence index dropped marginally in May as concerns about the rising inflation continued to be a factor. The ISM PMI accelerated to 56.1 in May 2022 from the 16-month low of 55.4 in the previous month, on the back of companies increased resilience in dealing with labour shortages at all tiers of the supply chain.

The number of jobless claims in May increased slightly compared to April, but the US labour market remains tight with an unemployment rate of 3.6% and increasing number of non-farm payrolls. The Standard & Poors 500 stock market index closed May 2022 at 4,132.15, practically at the same value as at the end of April. The daily index reached its monthly peak on May 4 but deteriorated sharply in the following days only to recover during the last week of the month. The market has been negatively affected by expectations of slowing growth amid high inflation although the Fed undertook interest rate hikes as a response to rising prices.

More about the US CEIC Leading Indicator here.

Further data and analysis on the US economy are available on the CEIC US Economy in a Snapshot – Q2 2022 report.