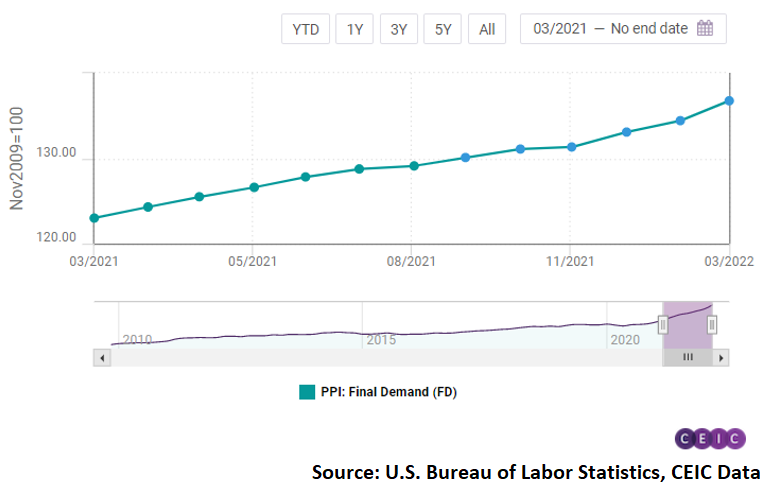

US producer prices again at record high, up 11.2% y/y in March

According to March 2022 data from the US Bureau of Labor Statistics, producer prices in the US increased by 11.2% y/y, the highest growth since data were first collected in 2010 and up 0.9 pp from the February reading. On a monthly basis, final demand PPI rose by 1.4%, seasonally adjusted, another record. The indices for food and energy, which were driving overall PPI up throughout 2021, continued to be a factor, jumping by 16.2% y/y and 36.7% y/y, respectively. Producer prices for goods increased by 15.7% y/y while services PPI rose by 8.7% y/y, both peak readings. Core PPI, which excludes volatile energy and food prices, increased by a record 10% y/y, and 1.2% m/m, seasonally adjusted.

The surging inflation prompted the US Federal Reserve to hike interest rates for the first time since 2018, albeit by just 25 basis points. However, with rising commodity prices due to the Russian invasion of Ukraine, it is expected that the Fed would raise interest rates again in the next policy meeting in May.

More data on US inflation in the US Monetary Policy and Financial Sector databank

Further data and analysis on the US economy are available on the CEIC US Economy in a Snapshot – Q2 2022 report.