Reports

Intel-Trump investment talks shore up chipmaker amid long-term headwinds

Reports

Washington diners stayed home: daily restaurant data and discretionary spending

Reports

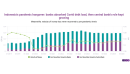

Investors spurn US equity funds and globally diversify as post-tariff order emerges

Reports

How Bank Indonesia ended up owning so much debt amid shaky economy

Reports

What's behind the Philippine peso's depreciation

Reports

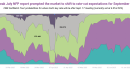

US job data aftershocks: markets rapidly price In September rate cut

Reports

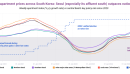

Manufacturing exports in China move further into global supply chains

Reports

Seoul housing boom prompts South Korea’s tighter mortgage rules

Reports