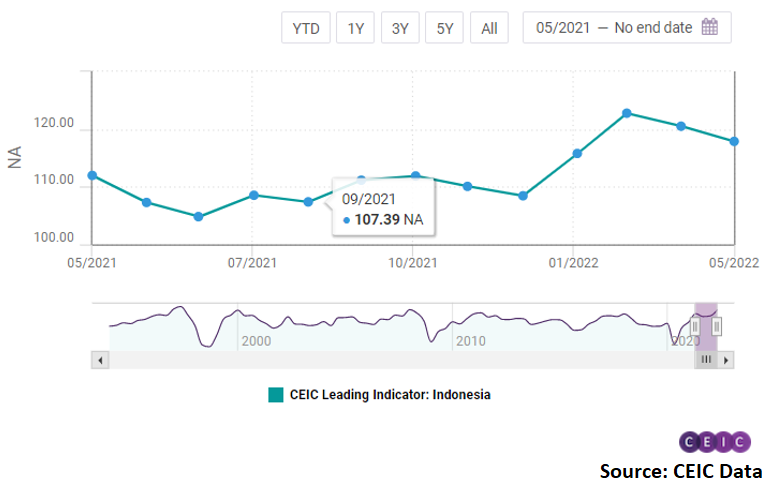

CEIC Leading Indicator for Indonesia slows further in May

The CEIC Leading Indicator for Indonesia decelerated for the second consecutive month in May 2022, according to the flash estimate. The non-smoothed indicator fell 2.6 points m/m to 117.9, as exports and motor vehicle sales underperformed compared to the previous month. Nevertheless, the indicator performs well above the long-term trend of 100 and is among the best performing economies surveyed by the CEIC Leading Indicator.

The median crude palm oil price remained almost unchanged in May, at USD 1,761.7 per tonne, after peaking in March. Motor vehicle sales dropped by 9.8% y/y, the first annual decrease since March 2021, as early May Eid holidays and the suspension of the luxury tax discount which was in place until March affected the automobile market in Indonesia. Non-oil and gas exports dropped sharply in May, shrinking by 22.7% m/m as the export ban on palm oil affected trade revenues. The reduction of the trade surplus influenced the rupiah which depreciated to IDR 14,544 per USD, the worst performance since March 2021. The Jakarta composite stock exchange index closed May down 1.1% m/m, ending five consecutive months of monthly increases.

The smoothed CEIC Leading Indicator rose to 120.5 in May, signalling that the country is still in the expansionary phase of the business cycle. However, the pace of expansion has been steadily declining since March which indicates that Indonesia could be approaching the business cycle peak.

Further data and analysis on the Indonesian economy are available on the CEIC Indonesia Economy in a Snapshot – Q2 2022 report