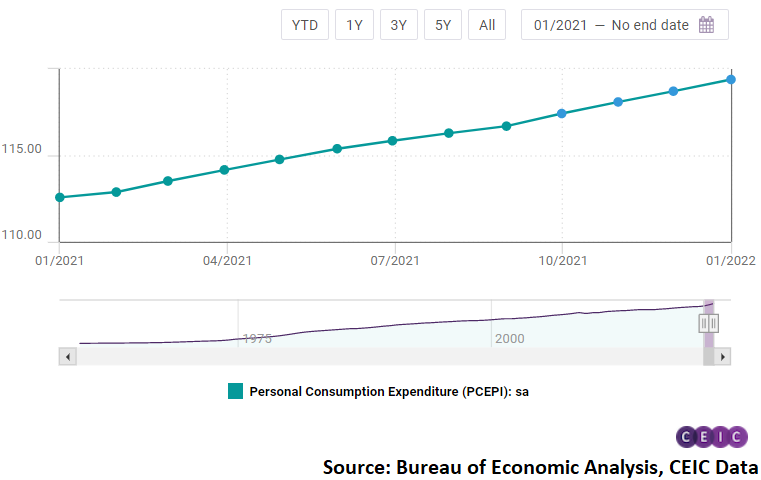

US personal consumption inflation hits 6.1% in January, core PCE index at 5.2%

United States PCE price index stood at 119.4 in January 2022 compared to a revised 118.7 in the previous month which translates to a 6.1% annual and 0.6% monthly growth, seasonally adjusted. The core PCE index which excludes food and energy prices rose by 5.2% y/y and 0.5% m/m. Inflation in goods prices accelerated to 0.9% m/m from 0.7% m/m in December, while prices of services decelerated marginally to 0.4% m/m from 0.5% m/m in the previous month.

The personal consumption expenditure (PCE) price index is Fed's preferred gauge for inflation, not the CPI. There are three major differences between these indicators, according to the Federal Reserve Bank of Cleveland. The first one is weight-related with the CPI being based on a survey of what households are buying, while the PCE focuses on what businesses are selling. Second, the PCE covers non-direct expenditures like insurance paid via the employer, which the CPI does not. And third is the so-called formula effect, meaning the PCE reflects substitution of goods when one gets more expensive.

The inflation measured by both the PCE index and the CPI is the highest in 40 years which could be detrimental to the otherwise strong US economic recovery. The Federal reserve kept the benchmark interest rate unchanged in the January policy meeting but there are strong indications that there will be rate hikes in the next policy meeting in March.

More data on US PCE inflation, personal income and expenditure here: