Medium Lending Facility and Loan Prime Rate: February 2020

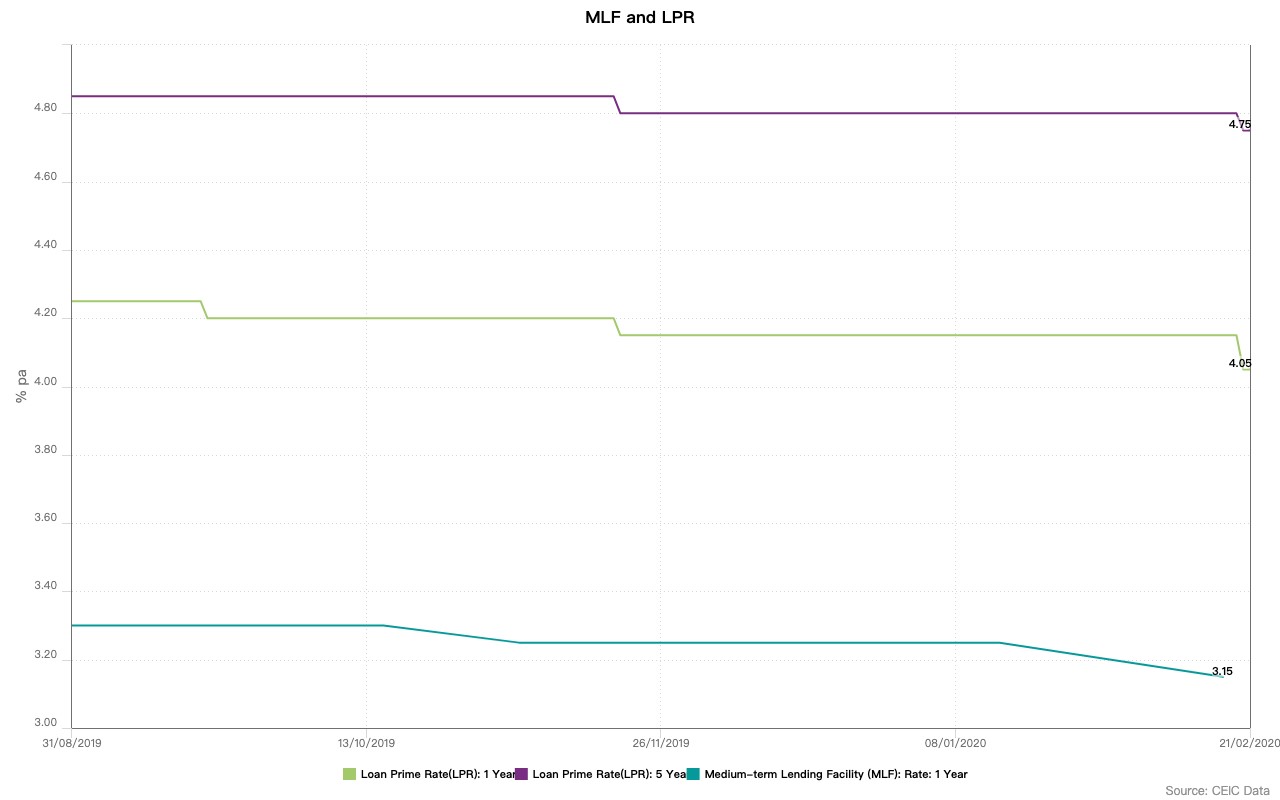

On February 17, 2020, the People’s Bank of China (PBoC) cut the interest rate on its one-year medium-term lending facility (MFL) in a bid to cope with the negative impact of the coronavirus (Covid-19) on business activity. The rate was cut by 10bp to 3.15%, which is the lowest rate since March 2017. Through this measure, the central bank essentially provided liquidity worth RMB 200bn to the commercial banks.

Three days later, the PBoC cut the one-year and five-year loan prime rates (LPR) too. The one-year LPR was cut by 10bp to 4.05% from 4.15%, in line with the market expectations, while the five-year LPR was set at 4.75%, down by 5bp. China introduced the LPR reform in August 2019 as part of the broader government effort to liberalise interest rates in the country.

Detailed data and analysis on China’s Monetary can be found in the CEIC China Economy in a Snapshot – Q4 2019.