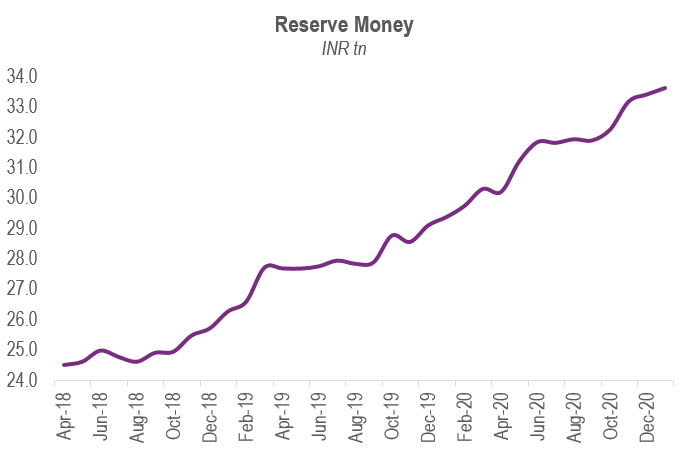

The historic increase in India’s foreign exchange reserves

Foreign reserves are external assets which are essential for monetary policy formulation and exchange rate management. The reserve money can be in the form of gold, special drawing rights (SDRs), and foreign currency assets such as external commercial borrowings, and inflows into capital markets.

Source: Reserve Bank of India

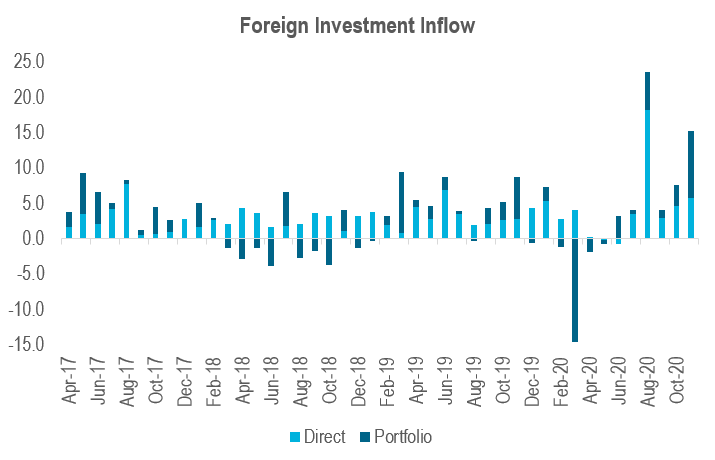

In the aftermath of the COVID-19 pandemic, governments and central banks have eased borrowing to boost economic performance, and India has become a beneficiary of the resultant liquidity in the international markets. Since June, there has been a surge in foreign exchange reserves primarily due to an increase in foreign investments, both portfolio investments and direct investments.

Source: Reserve Bank of India

Download our free webinar recording - "India's Budget 2021-2022 | Economy vs Finance in a Pandemic". Take a look at our full list of archived webinars here.