COVID-19 hits China’s Fiscal Revenue in January and February 2020

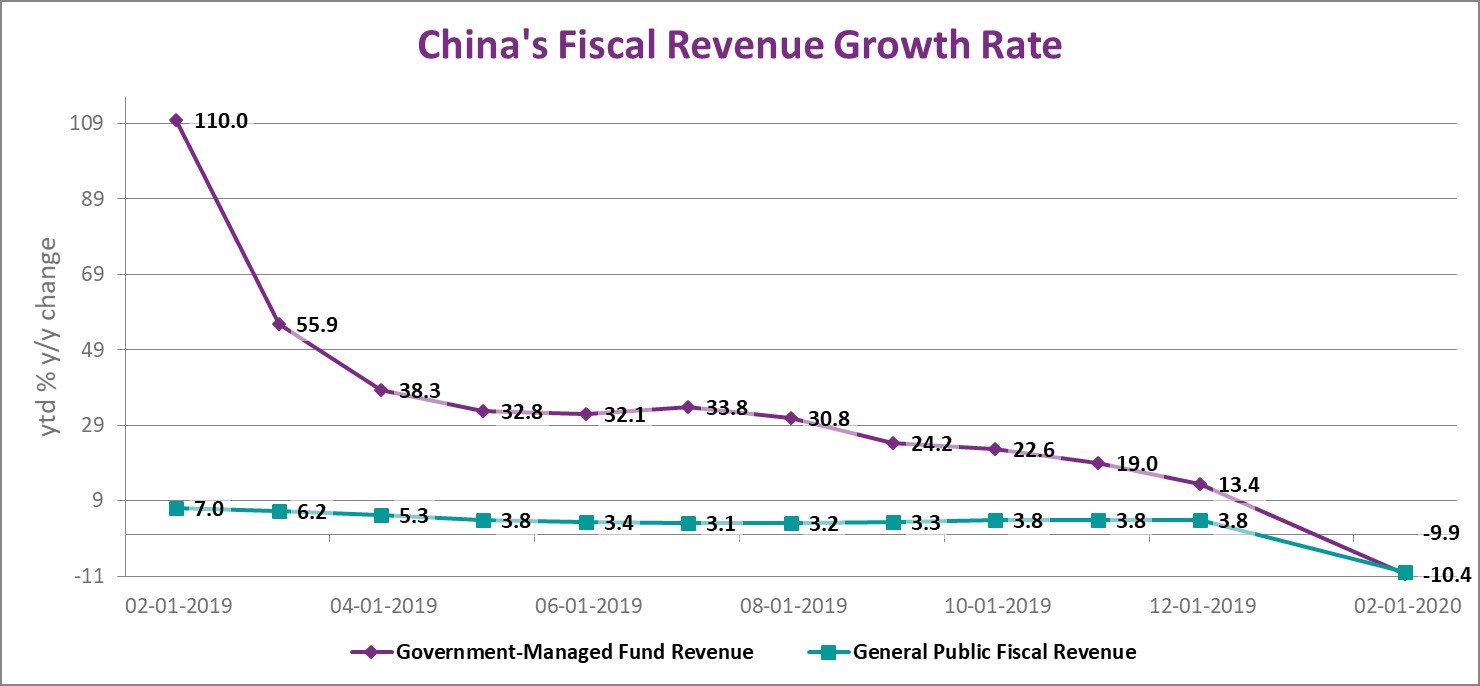

In January and February 2020, China’s fiscal revenue dropped substantially, reflecting the negative impact the Covid-19 outbreak has on the public finances.

For the first two months in 2020, China’s general public fiscal revenue plummeted by 9.9% y/y, compared to the same period in 2019. Back then a 7% y/y rise was recorded. The decline in 2020 is the biggest drop since February 2009.

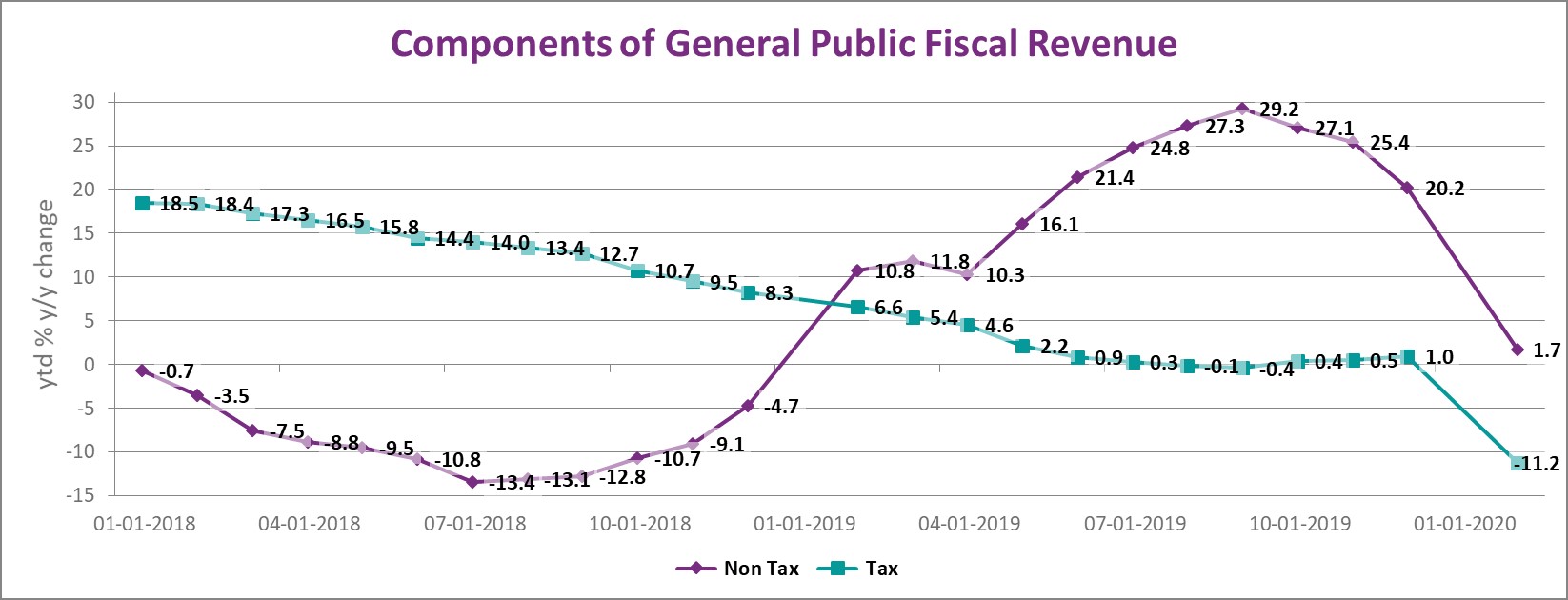

The data breakdown reveals that this decrease is mainly caused by an 11% y/y plunge in tax revenue. The tax revenue from exports and imports plummeted by 27% y/y and 25% y/y, respectively.

The value-added tax revenue, a frequently used indicator for China’s industrial activity, dropped by 19% y/y, compared to an 11% y/y rise for the same period in 2019. The consumption tax declined by 10% y/y, compared to a 27% y/y increase a year earlier.

China’s government-managed fund revenue decreased by 10.4% y/y, registering its biggest drop on record.

Detailed data and analysis on China’s Fiscal Sector can be found in the CEIC China Economy in a Snapshot – Q1 2020.