India's demand for individual single life insurance policies increased in FY2021

The life insurance sector in India has seen a fair degree of improvement since the lows in March and April 2020, but its yet to spring back to the pre-pandemic levels. However, there has been substantial change across the various types of life insurance policies.

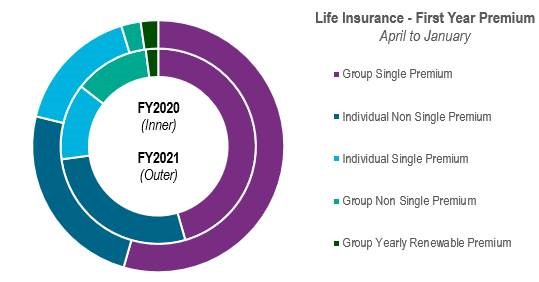

The group non-single premium had increased substantially over the April-January period of FY2020, but over the same period for FY2021, the individual single premium segment has grown at the highest rate.

Source: Insurance Regulatory and Development Authority

The group single premium occupied the largest share of new policies purchased, or total first year premiums, followed by individual non-single premium, and individual single premium. The share of group non single premiums decreased substantially from 12% in FY2020 Apr-Jan, to 2% in FY2021 Apr-Jan.

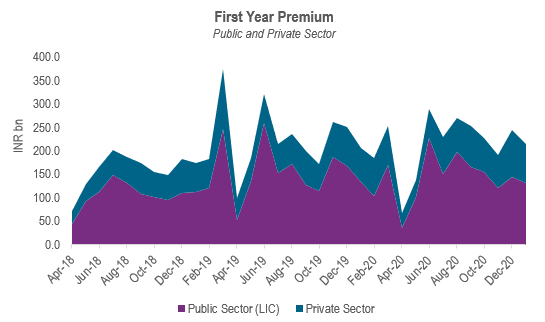

Source: Insurance Regulatory and Development Authority

India’s largest and only public sector insurance agency, the Life Insurance Corporation, remains the major provider of life insurance in India with more than 60% of new policies.

Download our free webinar recording - "India's Budget 2021-2022 | Economy vs Finance in a Pandemic". Take a look at our full list of archived webinars here.