中国: 中小銀行の不良債権カバー率を引き下げ

On April 21, 2020, China’s State Council lowered the provision coverage ratio for medium and small commercial banks by 20pp to the range of 100%-130%.

The provision coverage ratio measures a bank’s ability to absorb the gross non-performing assets. A higher ratio means the bank is better equipped to withstand such potential losses.

According to the authorities in Beijing, this move could encourage banks to release more credit to support small and micro-sized enterprises.

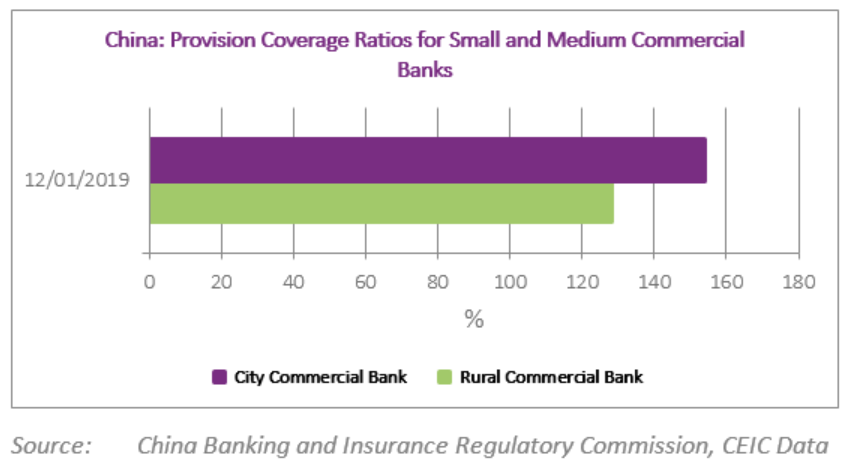

At the end of 2019, the bad-loan coverage ratio for the city commercial banks was 154%, higher than the minimum required, as the chart shows. Тhe figure for the rural commercial banks was 128%, within the target range at that time, but lower than the one for the city commercial banks.

Sign in for detailed data and analysis on China’s Economy in the CEIC China Economy in a Snapshot – Q2 2020.