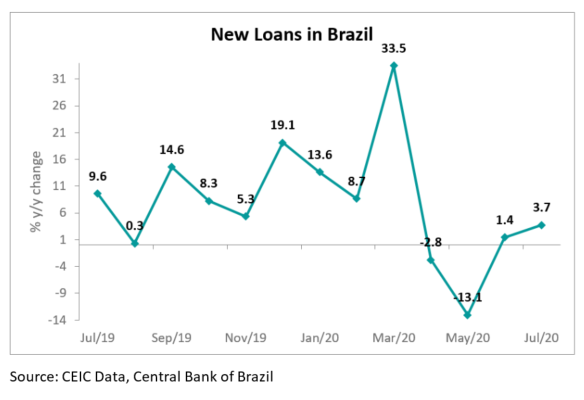

New bank loans in Brazil rose in July

New bank loans in Brazil grew by 3.7% y/y to BRL 340.8bn in July, reflecting the central bank’s stimulus package to deal with the COVID-19 negative economic impact. Since March, the central bank has adopted measures to increase liquidity in the financial system and introduced capital requirements reliefs for banks.

In July, the new loans for non-financial companies jumped by 15.4% y/y, influenced by the surge of working capital loans, particularly for small and medium enterprises. However, new loans for households dropped by 5.3% y/y in July, as consumers are using less credit card and overdraft.

Further data and analysis on Brazil’s economy could be found on the CEIC Brazil Economy in a Snapshot – Q2 2020 report.