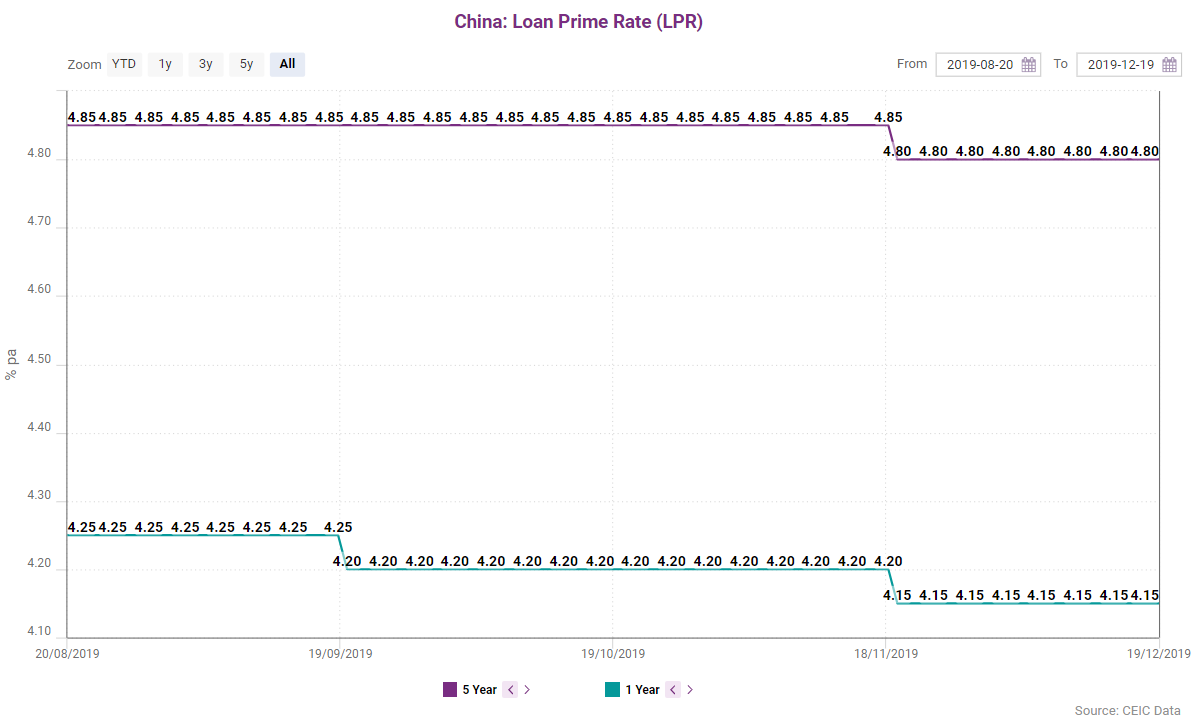

China: Loan Prime Rate

China’s one-year Loan Prime Rate (LPR) decreased by 5 bps to 4.15% in November from 4.20% in October. The five-year LPR edged down by 5bps as well to 4.80% in November from 4.85% in October.

China introduced the LPR reform in August 2019 as part of the broader government effort to liberalise interest rates in the country. The declines in the two rates, recorded in November, might be interpreted as a signal that the measure is actually taking effect, especially after both figures remained unchanged in October.

Тhe real success of the LPR reform, however, depends on the successful implementation of other structural changes such as developing an efficient fund transfer pricing system for commercial banks, competitive neutrality for the state owned enterprises and efficient bankruptcy legislation.

In-depth analysis of the LPR-reform in China could be found in the opinion article on CEIC blog and detailed data on China’s Monetary Policy can be found in the CEIC China Economy in a Snapshot – Q3 2019.