Fed Makes an Emergency Rate Cut Due to the Covid-19 Outbreak

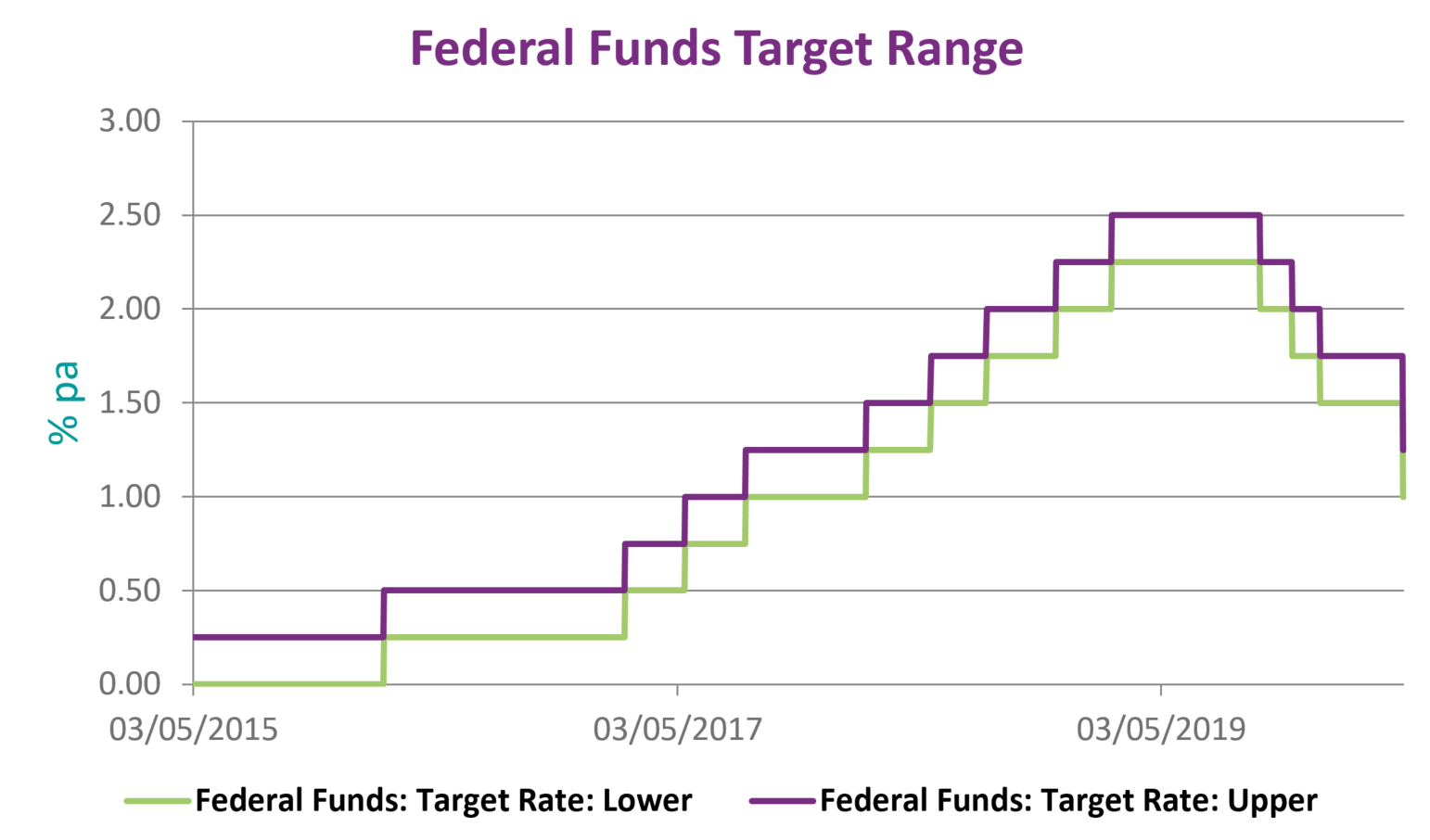

The US Federal Reserve undertook an emergency rate cut on March 3, 2020, due to the risks to economic activity posed by the coronavirus (Covid-19) outbreak. The Federal Open Market Committee (FOMC) slashed the fed funds target range by 50 basis points to 1% - 1.25%.

The last time the committee made an emergency rate cut was in 2008, as the global financial crisis was unfolding. Further, this is the biggest one-time rate cut since the recession back then. All of the cuts or hikes in the interest rates, that Fed undertook since 2015, when it began the monetary policy tightening, were by 25 bp.

The cut itself was largely anticipated, its timing and scope, however, were hard to predict by the markets. The FOMC stated that the fundamentals of the US economy remain strong, but in the light of the risks associated with Covid-19 and in support of achieving its maximum employment and price stability goals, it decided to lower the fed funds target range.

The Committee continues to closely monitor the developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.

Detailed data and analysis on COV-2019 and its economic impact can be found in CEIC’s Novel Coronavirus Outbreak Monitor.